|

Most local governments do not allocate indirect costs down to the level of individual programs, services, and activities. Examples of programs, services, and activities (hereafter “activities”) to which costs might be allocated are a weed abatement program, a grant-funded construction project, or a swim class.

As a result of not fully allocating costs, governments don’t typically know the full cost of providing each activity. They don’t know which activities are being subsidized and by what amount. They can’t answer important budget questions like:

When I was a young auditor, I audited a large chain drug store. It subsequently went out of business as Walmart grew. The main reason? They did not know the profit margin of every individual product they sold. Instead of measuring the profitability of every product, they only measured total store profit and relied on the store manager’s judgment instead of on data.

Therefore, they could not maximize shelf space for their most profitable products as well as Walmart did. How poor cost allocation affects governments

While governments are not likely to go out of business, if they don’t operate efficiently, they are usually tasked with “doing more for less”. Knowing the cost of each activity is important because it provides data about whether services are provided efficiently and whether efficiency is improving or deteriorating.

The Government Finance Officers Association (GFOA), in its Best Practices advisory Indirect Cost Allocation, “encourages governments to allocate their indirect costs”. In its advisory Full Cost Accounting for Government Services, GFOA “recommends that governments calculate the full cost of the different services they provide.” It goes on to describe such “full cost” as: The full cost of a service encompasses all direct and indirect costs related to that service. Direct costs include the salaries, wages, and benefits of employees while they are exclusively working on the delivery of the service, as well as the materials and supplies, and other associated operating costs such as utilities and rent, training and travel. Likewise, they include costs that may not be fully funded in the current period such as compensated absences, interest expense, depreciation or a use allowance, and pensions. Indirect costs include shared administrative expenses within the work unit and in one or more support functions outside the work unit (e.g., legal, finance, human resources, facilities, maintenance, technology).

When governments need to determine fully allocated costs of certain services (e.g., establishing fees and charges, charging back the cost of internal services to departments, or requesting reimbursement of grants), they usually engage a cost allocation consultant every few years (frequently in conjunction with updating user fees and charges) to prepare a cost allocation plan to allocate indirect costs for these limited purposes. This periodic cost allocation is based on historic financial data at the time it is developed but may not be accurate when used in future years.

Governments are, in effect, service organizations, because they primarily provide public services to their citizens/taxpayers. Most other service organizations are more sophisticated in their accounting for indirect costs. For example, lawyers, CPAs, and consultants of all types require employees to keep close track of their time by the project so clients can be accurately billed. They know the profitability of every project and the efficiency of their employees. Although governments do not bill clients, they still need financial data to understand how efficiently they operate.

When your government is ready to start fully allocating indirect costs, here are the key steps to go through:

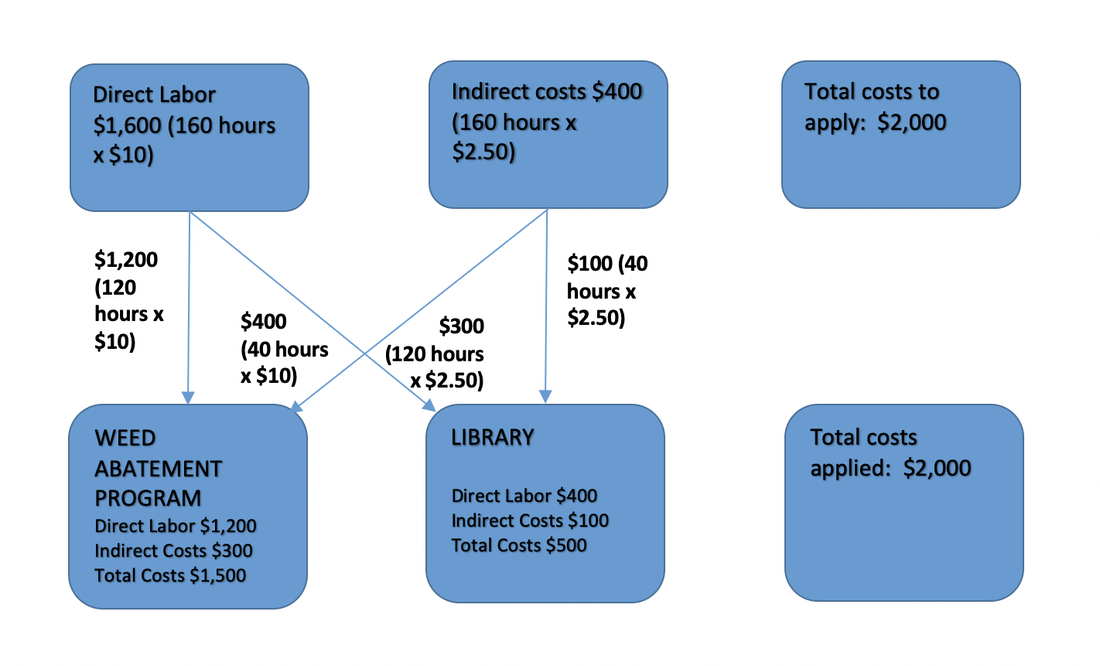

Below is a simple example of a cost allocation of $400 of indirect costs to two programs based on the number of direct labor hours:

If you have more questions on how you can better allocate indirect costs, feel free to reach out to Kevin directly:

Kevin Harper, CPA kharper@kevinharpercpa.com (510) 593-503

If you'd like to get more free tips, as well as downloadable tools and templates for your agency, please join our mailing list here!

(We’ll send you a monthly curated selection of our blog posts. You can unsubscribe at any time.) |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed