|

Recently, I was engaged to audit the effectiveness and efficiency of a City’s payroll process. I asked the payroll clerk whether employees submitted timesheets on time: Clerk: We get about 95% of the timesheets on time. Me: The 5% you don’t get on time is about 50 timesheets. Is it the same employees each month who are submitting late? Clerk: Yes, I can tell you in advance exactly who will not submit their timesheet until I call them. Me: Are there any consequences for employees who continually submit timesheets late? Clerk: No. I used to tell their supervisor, but nothing ever happened. Me: Do you escalate it to their manager, the Finance Director, or City Manager? Clerk: No. Me: Do you keep a list of every time a timesheet is late so that you can get city management’s help with this problem? Clerk: No. This is an example of a city that is experiencing a common inefficiency in its payroll process – late timesheet submittal. Having an inefficient payroll process can be costly and burdensome for a city to manage. The main negative consequences of payroll processes are:

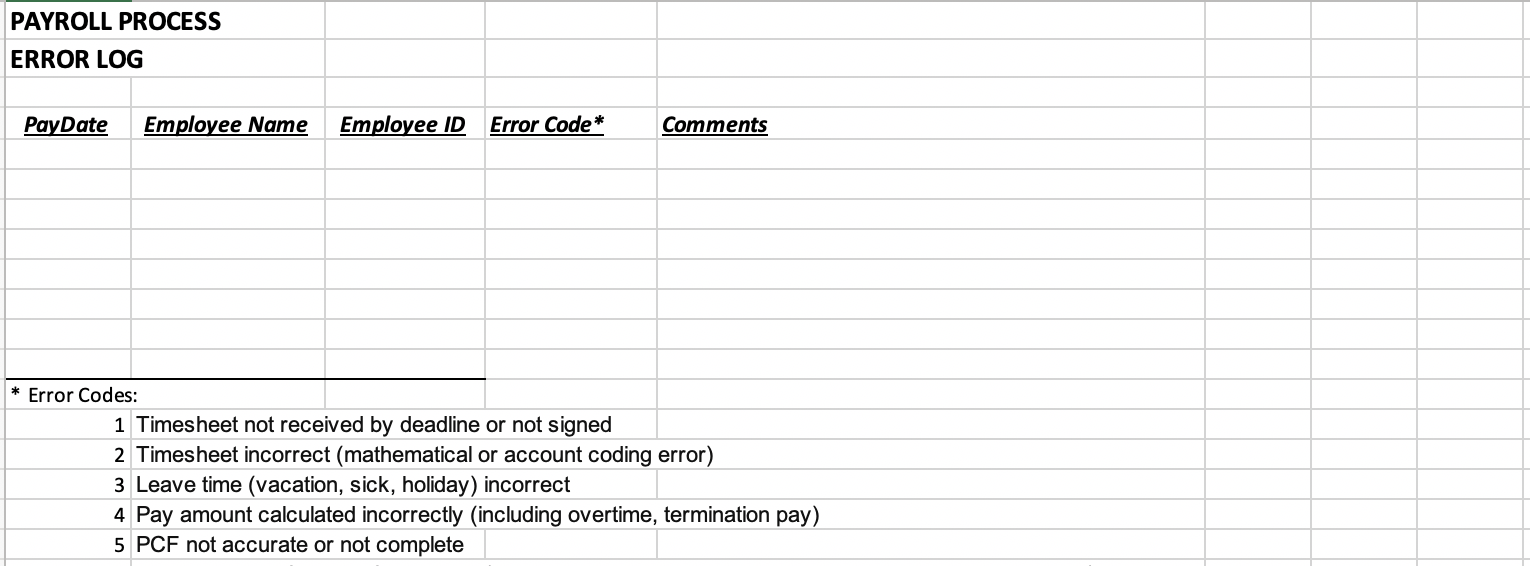

Unfortunately, the city in the example above is not doing anything to address this inefficiency; they are just finding ways to work around the problem. Worse, managers in the position to be able to improve the situation are apparently not even aware of the problem. Payroll is a complex business process requiring the cooperation of all employees, and with many continually changing elements (e.g., new laws, accounting standards, policies, technology, stakeholder expectations, etc.). Because of this, the effectiveness and efficiency of the payroll process (like any complex process), is deteriorating unless efforts are underway to improve it. How to improve the payroll process?One good way to monitor whether your payroll process is improving or deteriorating is to keep an error log. Every transaction that causes personal intervention should be logged and later reviewed to identify trends and to develop action plans to improve significant recurring inefficiencies. This error log should be simple enough to maintain and include the following: 1) just enough information to allow the transaction to be located in the accounting records; and 2) an error code to allow sorting of errors by type. For example, error codes may include:

The error logs should be summarized quarterly and examined by Finance management for trends. Any recurring errors are evidence of the need for improvement of either procedures or compliance with procedures. If you have more questions about the payroll process or error logs, feel free to reach out to Kevin directly:

kharper@kevinharpercpa.com (510) 593-5037

Comments

|

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed