|

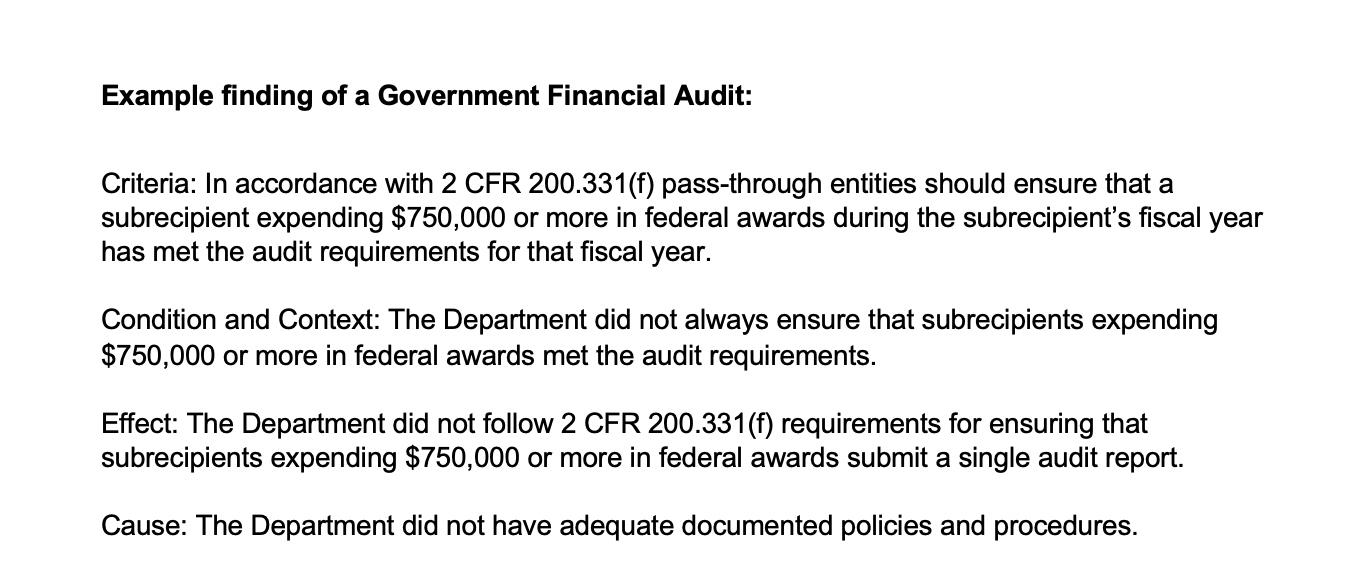

Local governments get audited all the time – by the annual independent auditors, the internal auditor, various granting agencies, and various taxing and regulatory agencies. No matter how competent your Finance Department is, it is inevitable that some of its various auditors will issue audit findings. The most frequent audit findings are from the annual independent auditors. Their findings are categorized as a) material weaknesses in internal control, b) significant deficiencies in internal control, and c) other matters of interest to governing officials. If the annual independent auditors conduct a single audit of federal financial assistance programs, additional categories of findings are a) non-compliance with laws and regulations that are material to the financial statements, and b) non-compliance with federal grant regulations that are material to a federal financial assistance program. Audit findings are generally accompanied by recommended corrective action. How should you respond to audit findings? |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed