|

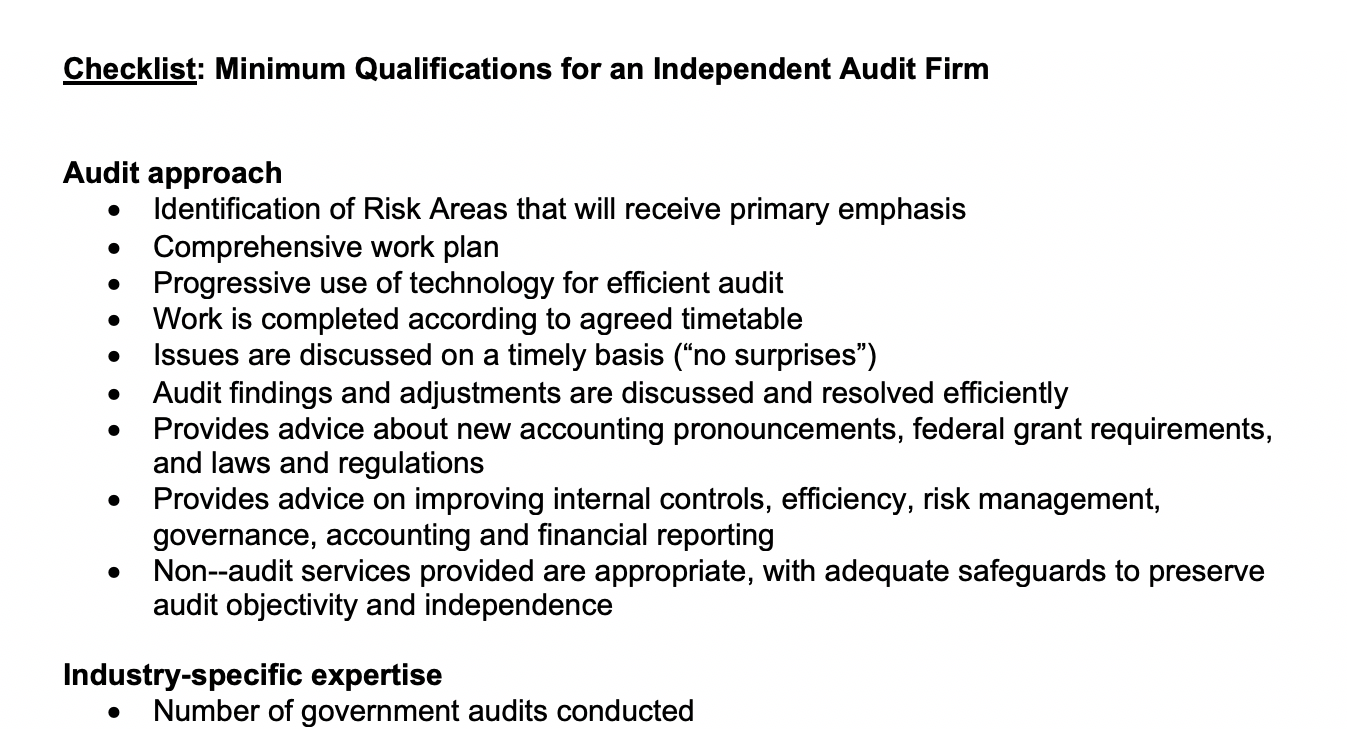

Selecting an independent auditor can be a challenging task. You will want a firm that is experienced with serving local governments, who not only knows GASB pronouncements, federal grant requirements, and applicable laws and regulations, but – most importantly – can assist you in ensuring compliance of these principles. You will want an auditor who works well with you and your team, not one who simply has a “gotcha!” mentality. In addition, you want one who is friendly, professional, and easy to reach when you need them. Needless to say, you want all this at a reasonable cost. Here are some of the most important considerations in selecting (or retaining) an independent audit firm: |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed