|

Petty cash has long been a quick method to allow for the reimbursement or purchase of small-dollar, unanticipated business expenses, such as a stamp or cup of coffee. Instead of writing a check, it was just more efficient to pay in cash. When a government didn’t provide access to purchasing cards, or employees would rather not wait to be reimbursed for purchases, using petty cash was historically a simple alternative. What Are the Disadvantages of Petty Cash?

In these days, petty cash is a largely outdated and inefficient system. While convenient for small purchases, it is challenging for Finance Departments to track outgoing petty cash, match them with receipts, and record appropriate expenses in the general ledger. Many governments do not even try to record petty cash transactions to the correct expense classification because the high number of low-dollar transactions makes it too time consuming. Instead, they post all transactions to miscellaneous expense.

However, cash transactions can add up quickly. For instance, if your office has a Keurig coffee machine, you’re probably spending around 26 cents per cup of coffee. Since an average coffee-drinking employee has 3.1 cups per day, you could be spending more than $100 a year on each employee’s caffeine consumption! Now, multiply that by the number of employees who drink coffee. You could be spending thousands of dollars per year on small, daily expenses that don’t get properly recorded in the accounting records. In addition, cash is the most frequent asset stolen because it is easily spendable. This makes the petty cash system susceptible to abuse or fraud. For most governments, these downsides of using petty cash outweigh the advantages. What Are Better Alternatives to Cash?

Petty cash funds began being used when “cash was king”. That is no longer the case. Nowadays, there are numerous methods of paying for small purchases that are more efficient and secure than petty cash. Some governments have closed their petty cash funds and instead instructed employees to use purchasing cards, use open lines of credit with supplies stores, pay with their own credit card and seek reimbursement, or the government issues prepaid debit cards or credit cards to employees.

Prepaid cards frequently earn cash back or rewards and provide an auditable digital record of every transaction. Everything from lunch to a subway ride can be charged on the prepaid card. That means less people touching cash, which reduces your risk of loss. Another option is digital wallets with which you can reimburse employees if they purchase anything on behalf of the government. Using an app like Venmo, you can quickly pay them back, which is not only an effective way to ensuring that they don’t abuse the petty cash system, but this also has a record so you can easily keep track of expenses. The coronavirus pandemic has led to a dramatic increase in digital payment. According to a recent report by Square, the new “safety-first approach to business" has led to an increase in the number of cashless businesses in the U.S., going from 8% on March 1, 2020 to 31% on April 23, 2020. Now is the time for you to improve internal controls and efficiency, and close your petty cash funds. How to Close Out

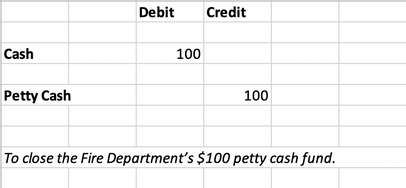

When closing a petty cash fund, you should do the following:

Following these tips should turn your disorganized, hard-to-track petty cash into more reliable, efficient fund options for your agency.

If you have more questions related to petty cash funds or its more efficient alternatives, feel free to reach out to Kevin directly:

Kevin Harper, CPA kharper@kevinharpercpa.com (510) 593-503

If you'd like to get more free tips, as well as downloadable tools and templates for your agency, please join our mailing list here!

(We’ll send you a monthly curated selection of our blog posts. You can unsubscribe at any time.) |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed