Subrecipient Monitoring Procedures – How to Identify and Distinguish Subrecipients from Contractors3/14/2019

Any local government that passes federal funds to a subrecipient, who is a state, local government, Indian tribe, institution of higher education, or nonprofit organization, is required to monitor those subrecipients according to the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (the “Uniform Guidance”) published by the Office of Management and Budget. But before you can monitor subrecipients, you must first identify them and distinguish them from contractors (who don’t need to be monitored).

In a previous post, we provided basic definitions and terms related to subrecipient monitoring procedures. In this post below, we describe subrecipients vs. contractors and how to distinguish them correctly.

Excerpts from the Uniform Guidance

Following are relevant excerpts from the Uniform Guidance

§200.331 Requirements for pass-through entities.

All pass-through entities must: (d) Monitor the activities of the subrecipient as necessary to ensure that the subaward is used for authorized purposes, in compliance with Federal statutes, regulations, and the terms and conditions of the subaward; and that subaward performance goals are achieved. §200.330 Subrecipient and contractor determinations. The non-Federal entity may concurrently receive Federal awards as a recipient, a subrecipient, and a contractor, depending on the substance of its agreements with Federal awarding agencies and pass-through entities. Therefore, a pass-through entity must make case-by-case determinations whether each agreement it makes for the disbursement of Federal program funds casts the party receiving the funds in the role of a subrecipient or a contractor. The Federal awarding agency may supply and require recipients to comply with additional guidance to support these determinations provided such guidance does not conflict with this section. (a) Subrecipients. A subaward is for the purpose of carrying out a portion of a Federal award and creates a Federal assistance relationship with the subrecipient. See §200.92 Subaward. Characteristics which support the classification of the non-Federal entity as a subrecipient include when the non-Federal entity: (1) Determines who is eligible to receive what Federal assistance; (2) Has its performance measured in relation to whether objectives of a Federal program were met; (3) Has responsibility for programmatic decision making; (4) Is responsible for adherence to applicable Federal program requirements specified in the Federal award; and (5) In accordance with its agreement, uses the Federal funds to carry out a program for a public purpose specified in authorizing statute, as opposed to providing goods or services for the benefit of the pass-through entity. (b) Contractors. A contract is for the purpose of obtaining goods and services for the non-Federal entity's own use and creates a procurement relationship with the contractor. See §200.22 Contract. Characteristics indicative of a procurement relationship between the non-Federal entity and a contractor are when the contractor: (1) Provides the goods and services within normal business operations; (2) Provides similar goods or services to many different purchasers; (3) Normally operates in a competitive environment; (4) Provides goods or services that are ancillary to the operation of the Federal program; and (5) Is not subject to compliance requirements of the Federal program as a result of the agreement, though similar requirements may apply for other reasons. (c) Use of judgment in making determination. In determining whether an agreement between a pass-through entity and another non-Federal entity casts the latter as a subrecipient or a contractor, the substance of the relationship is more important than the form of the agreement. All of the characteristics listed above may not be present in all cases, and the pass-through entity must use judgment in classifying each agreement as a subaward or a procurement contract. §200.22 Contract. Contract means a legal instrument by which a non-Federal entity purchases property or services needed to carry out the project or program under a Federal award. The term as used in this part does not include a legal instrument, even if the non-Federal entity considers it a contract, when the substance of the transaction meets the definition of a Federal award or subaward (see §200.92 Subaward). §200.23 Contractor. Contractor means an entity that receives a contract as defined in §200.22 Contract. §200.69 Non-Federal entity. Non-Federal entity means a state, local government, Indian tribe, institution of higher education (IHE), or nonprofit organization that carries out a Federal award as a recipient or subrecipient. §200.74 Pass-through entity. Pass-through entity means a non-Federal entity that provides a subaward to a subrecipient to carry out part of a Federal program. §200.93 Subrecipient. Subrecipient means a non-Federal entity that receives a subaward from a pass-through entity to carry out part of a Federal program; but does not include an individual that is a beneficiary of such program. A subrecipient may also be a recipient of other Federal awards directly from a Federal awarding agency.

Important Considerations

Key points from the Uniform Guidance and from our experience working with pass-through entities:

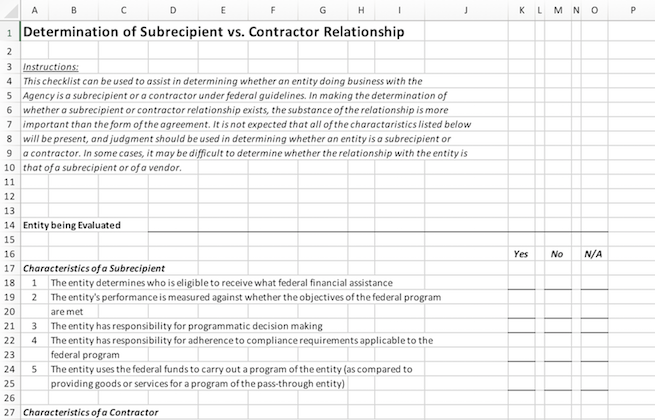

Completing the Subrecipient vs. Contractor Determination Checklist

Click the image above to download the checklist as an Excel file.

When awarding federal funds to a non-profit entity or a government, a pass-through entity must determine whether each agreement casts the non-profit or government as a subrecipient or as a contractor. Put another way, you must determine whether you are entering into a subaward or a procurement contract.

The pass-through entity should select an employee who fully understands the scope of work that the entity receiving federal funds is to provide. This employee should then complete the following Subrecipient vs. Contractor Determination checklist (click the link to directly view and download the file).

This checklist is composed of 10 questions, which are from the Uniform Guidance. If the answers to the first 5 fields are “yes,” it is evidence of a subrecipient relationship.

If the answers to the following 5 fields are “yes,” it is evidence of a contractor relationship. All 10 questions should be answered completely and to the best of knowledge of the employee.

Following is a short description of each question:

Common subrecipient characteristics include:

Common contractor characteristics include:

This checklist should be completed for each agreement that the pass-through entity enters into with it. Each agreement will have a different scope of work and therefore must be evaluated separately as a subrecipient of contractor relationship. A new checklist should be completed whenever there is a major amendment to the contract.

It should be noted that each question takes the judgment of the employee. Usually, there will be a preponderance of “yes” answers to either the subrecipient or contractor questions and a preponderance of “no” answers to the other. In this case it will be clear whether the entity is a subrecipient or a contractor. Occasionally, there will be no clear preponderance. In this case the employee should obtain a second opinion from other knowledgeable employees and/or should determine which of the 10 questions should be more heavily weighted in this case. The employee then decides whether the evidence points to a subrecipient or a contractor, completes the checklist and places it in the grantee file. It is critical that this documentation be available for auditors to review. As long as a conscientious effort is made to determine subrecipient vs. contractor, the pass-through entity should not be at risk during an audit.

Use this Determination of Subrecipient vs. Contractor Relationship checklist (click the link to directly view and download the file) to help you in your determination.

Other Blog Posts Related to Subrecipient Monitoring:

We have previously provided guidance on subrecipient monitoring in these blog posts (this list will get more extensive as new posts are added on):

Watch for upcoming blog posts about the Uniform Guidance requirements:

● Risk Assessment for Subrecipients ● Determining Appropriate Level of Monitoring ● Reviewing Financial and Programmatic Reports ● Data Collection

If you have questions or would like advice on how to implement the recommendations in this blog post in your organization, Kevin is available to answer questions via phone or email at no cost to you:

Kevin Harper, CPA kharper@kevinharpercpa.com (510) 593-5037

If you'd like to receive more free tips and downloadable tools & templates for your government agency, join our mailing list here!

(We send 1-2 emails a month at a maximum, and will only send useful information, never spam. You can unsubscribe at any time.)

Comments

|

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed