|

The pollution remediation costs your government must report in its annual financial statements may dramatically increase as a result of the Governmental Accounting Standards Board Statement No. 49, “Accounting and Financial Reporting for Pollution Remediation Obligations” (GASB 49). This four-part series will cover the requirements, potential liabilities and suggested operations that will help you implement these changes.

To read Part 1 of this series, click here. Below, in part 2, we'll show you simple guidelines and a template worksheet to identify whether your government might be affected by the GASB 49 requirements. Determine Whether Your Government Has Potential Liability

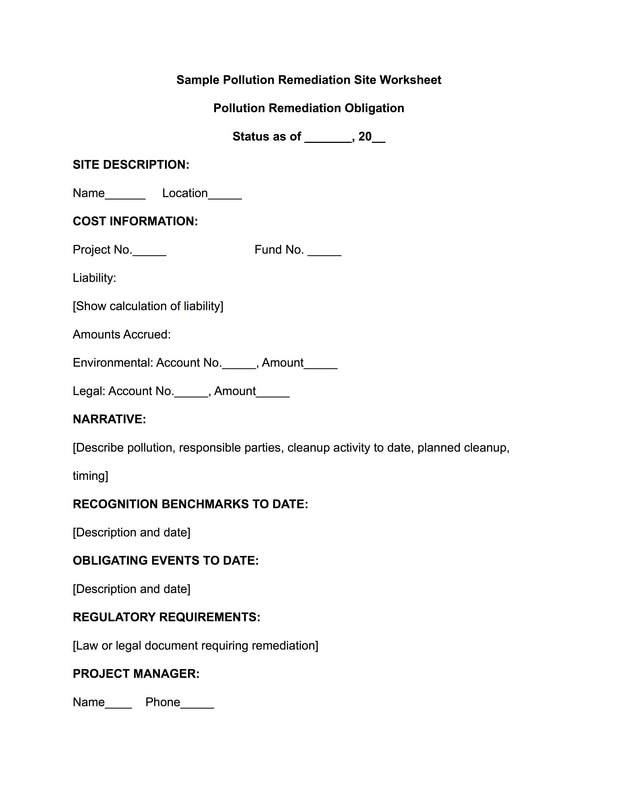

Does GASB 49 affect your government? If your government has polluted sites, form a work team composed of the individuals who are most knowledgeable about polluted sites, estimated costs to clean and monitor the sites, and legal or insurance claims and settlements that could offset those costs. The work team should collectively identify all polluted sites and compile such data as site description, location, regulatory actions taken to date, cleanup status, obligating events to date, and recognition benchmarks to date.

Below is an example of a worksheet used to document information about contaminated sites: Download the sample worksheet in Word format here.

Here's what the work team should ensure:

The next post, part 3 of this series will help you estimate pollution remediation liability. For help implementing any of the controls discussed in this series, or if you need further help in identifying whether your government might be affected, please reach out to me via email: kharper@kevinharpercpa.com For continued tips on how to successfully deal with these controls and more, subscribe here to our newsletter (we will never spam you – promise!).

Comments

|

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed