|

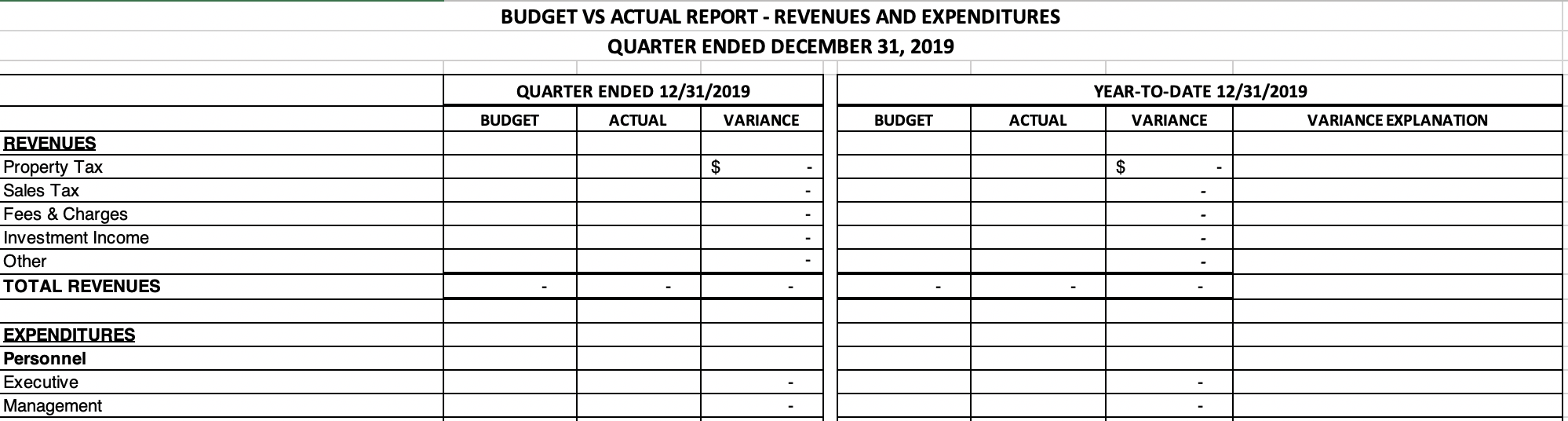

A critical element of any effective budgeting process is the monitoring and comparing of actual quarterly reports vs. the budget throughout the year. This is done to allow management time to make adjustments, if necessary, to expenditures, policies or operations if actual results are different than expected. The best way to monitor budget vs. actual results is to prepare a quarterly financial report that shows the current period and year-to-date budgeted amounts, actual amounts and variances for each budgeted line item. Click here to see an Excel sample for a proposed format for the quarterly budget vs. actual financial report.

Accounting staff should prepare a report like this and it should be reviewed by department and executive management, as well as by the Board/Council at a public meeting.

The budget vs. actual report should initially be prepared and analyzed at the same level of detail as the budget (i.e., every line item budgeted should be shown). The line items of the budget vs. actual report can subsequently be rolled up to present less detail depending on the needs of each user. For example, you may want a one-page easy-to-read version for the Board/Council, but will provide all detail for a department manager.

What About Variances?

Significant variances between year-to-date budgeted and actual amounts should be identified, explained and documented.

It is recommended to explain year-to-date variances instead of current period variances because analyzing year-to-date amounts (a) minimizes the effect of timing differences and (b) is the better predictor of the annual results. Operating managers will frequently need to be consulted to understand the reasons for variances. It is better to thoroughly research and explain the few very large variances than to do a more cursory explanation of many variances. The variances should be documented on the budget vs. actual financial report; a separate page may be needed. It is important to quantify variances that are explained. For example, it is not sufficient to say a $200,000 variance in personnel costs is due to 3 unfilled positions because it is not clear from that explanation whether those 3 positions account for 30% or 130% of the variance. Keep identifying and explaining (and quantifying) components of the variance until the unexplained remainder is not significant.

If you follow the above recommendations on budgeting, and maybe utilize our Budget vs Actual Report Sample Sheet, you agency will have a lower risk of running into issues managing actual quarterly reports with any planned budgets.

If you have more questions related to budgeting, feel free to reach out to Kevin directly:

Kevin Harper, CPA [email protected] (510) 593-503

If you'd like to get more free tips, as well as downloadable tools and templates for your agency, please join our mailing list here!

(We’ll send you a monthly curated selection of our blog posts. You can unsubscribe at any time.) |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

RSS Feed

RSS Feed