|

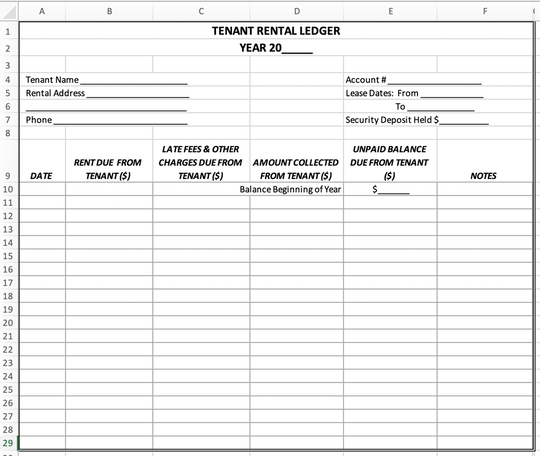

Does your government receive rental revenue? Most governments have small amounts of rental revenue or similar receivables. Sources can include low-cost housing, rental of unused office buildings, monthly rental of parking spaces, and concessionaires. Because most governments typically don’t have huge amounts of receivables to report (besides those that are due from other governments or from utility customers), they often do not have adequate receivable modules in the financial system and may not have staff that are adequately trained to track and manage tenant rental receivables. This can become a problem. One of our clients experienced a fraud related to its rental revenue (see this blog post about Minimizing Your Government’s Risk to Billing Fraud for more). This client is a state agency that owns an office building. It rents the ground floor of the building to various retail tenants and rents excess space on other floors to office tenants. The Rental Manager was responsible for billing and collecting tenant revenue. She submitted checks collected to the Finance Department for deposit. The Finance Department did not track whether amounts were billed timely nor whether billed amounts were collected. Over the course of several years, the Rental Manager embezzled several hundred thousand dollars. She did this by writing “/PLOT” on the payee line after the name of the government and was able to deposit stolen checks via ATM into a not-for-profit bank account that used the acronym PLOT. She served as volunteer treasurer for PLOT and from there she was able to access the funds. “Separating the billing and collection of rental revenue tasks is the single most control to ensure is in place. This fraud highlights two things: 1) You cannot rely on bank internal controls to assure checks written to your government are not cashed by others; and 2) separating the billing and collection of rental revenue tasks is the single most control to ensure is in place. If your government has rental revenue to manage, consider the following recommendations to minimize your risk of loss: |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed