|

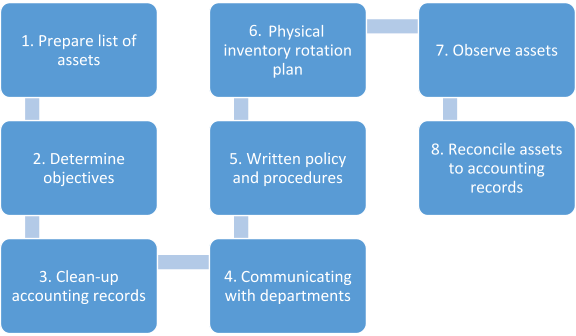

The GFOA recommends that governments inventory their tangible capital assets, at least on a test basis, no less than every five years. A practical interpretation of this recommendation is to observe moveable equipment every five years and other assets (land, buildings, infrastructure, non-moveable equipment) once every ten to twenty years. It is better to observe a portion of your capital assets each year on a rotational basis than to do them all at once every few years because it allows you to (a) test the adequacy of your internal controls each year and (b) build observation work into annual workloads so that you don’t need to engage consultants. Following is a typical process for conducting physical observation of capital assets. Each step of this process is discussed in more detail below: 1. Prepare list of assets

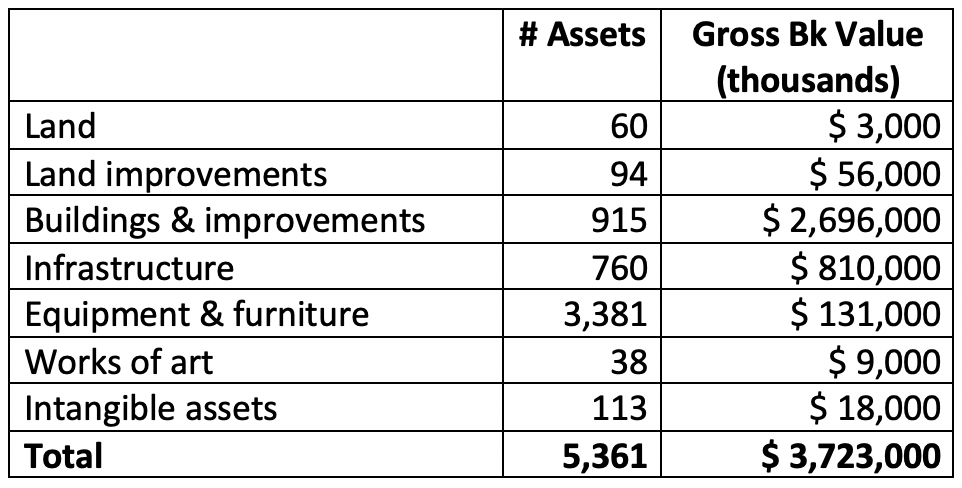

First, prepare a list of capital assets by type of asset. Following is an example of such a list:

This list will help decide the amount of effort that will be required to observe the assets. Some types of assets are easier to observe than others. For example:

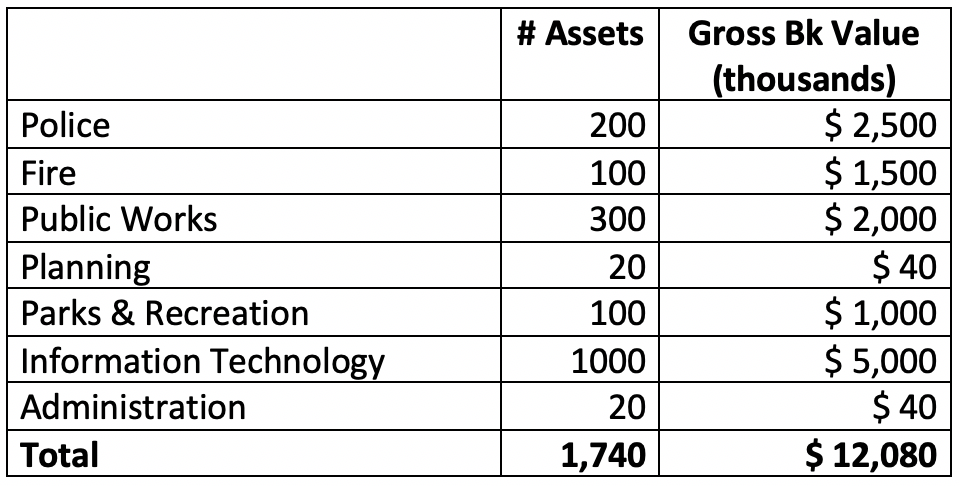

Second, you should prepare a list of assets by department or location. Following is an example of a list of capital assets sorted by department:

This list can be used to help determine the amount of time each department will need to devote to the observation. Some departments will have a better grip on the location of their assets and have reconciled to the accounting records more carefully. Third, “slice and dice” the capital asset data to identify the assets that may need special attention during the observations; for example, (a) assets that have zero book value, (b) assets that have gross book value less than the current capitalization thresholds, and (c) assets acquired in the current fiscal year.

2. Determine objectives

Before you can inventory fixed assets, you must decide what you will be trying to accomplish during the visits of the various departments and locations. You will of course be verifying that recorded assets actually exist. But will you also:

Every objective increases the amount of time, effort and cost that it takes to conduct the physical observations, so only important objectives should be undertaken.

Note that physical observations are not an efficient way to test for understatement of recorded capital assets. When assets are found that are not listed in the accounting records, it is hard to know whether the asset has been recorded in a different department or as a part of a larger asst. Also, capitalized assets do not normally cause financial statements to be misleading because understating assets and net position is more conservative. Accordingly, many governments do not attempt to identify unrecorded assets during the physical observations; rather they focus solely on making sure all recorded assets are still on-site. A practical middle-ground approach is to make a list of any very large assets noted during the observation that are not listed separately on the asset list. These assets can be researched later for whether they have been properly capitalized. It is important to decide up front what types of assets will be tagged. Moveable equipment only? All equipment and furniture? Weapons? Assets with cost less than capitalization thresholds? How many tags will be used when several assets are capitalized as a single line item in the accounting records? How many tags when one asset has several components that are each capitalized separately in the accounting records?

3. Clean-up the accounting records

Capital asset records are frequently inconsistent because different people recorded assets in different ways at different levels of detail, based on different policies over the decades. You may find substantial variation in how fixed assets have been capitalized over the years (e.g., 100 PCs bought on the same day could be capitalized as 100 lines, 1 line, or not capitalized because each PC is under the capitalization threshold).

To make capital asset observations as easy as possible, the capital asset records should be scrubbed. Specifically, you should:

4. Communicating with departments

Department staff will play a key role in the observations. They need to identify the location of each asset to the observer; complete paperwork for fixed asset additions, disposal or transfers; update department records; and provide various information about assets. Accordingly, it is important to communicate effectively with them throughout the project. Such communication should include:

5. Written policies and procedures

If you don’t already have written procedures related to capital asset observations, now is the time to develop them. Written procedures help get all employees who are involved in the observations on the same page, knowing their role in the overall process. The written procedures are generally part of the government’s overall capital assets policy and procedures. These procedures should include, at a minimum, the following:

See this attachment for a sample capital asset observation document and tagging procedures. (Click the link to view and download in Word-format.)

6. Physical inventory observation plan

As you plan the physical observations, you will need to develop an observation plan and approach. This plan should consider the following:

You should design the count sheet to be used during the observations to document the information collected and the changes needed to be made to the accounting records. See this attachment for a sample count sheet.

(Click the link to view and download in Excel-format.) This count sheet allows documentation of:

Step #7 and #8, observing assets and reconciling assets to the accounting records, will be addressed in our next blog post here.

Please also visit our Resources page for a collection of all of our attachments and templates, as well as a link to a recent presentation for inventorying capital assets.

If you have more questions related to inventorying capital assets, feel free to reach out to Kevin directly:

Kevin Harper, CPA kharper@kevinharpercpa.com (510) 593-503

If you'd like to get more free tips, as well as downloadable tools and templates for your agency, please join our mailing list here!

(We’ll send you a monthly curated selection of our blog posts. You can unsubscribe at any time.) |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed