|

In my experience as a CPA serving local governments for 30 years, there are seven “deadly sins” related to cash collections. If the local government commits one of these sins, it is risking the ultimate penalty. This series of blog posts will describe each of the seven deadly sins of cash collections. If your government is currently sinning, repent and you can be saved.

I have deadly sin #2 and #3 for you below... Deadly Sin #2 - Failure to Perform Complete and Timely Bank Reconciliations.

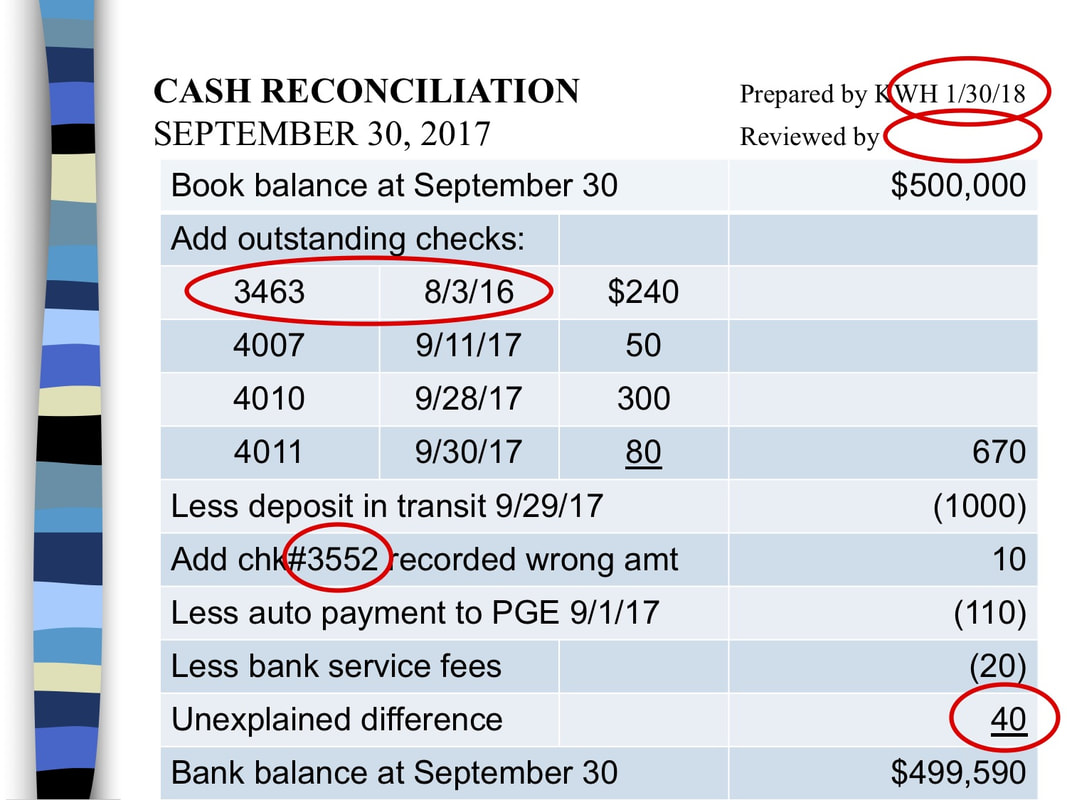

(click to enlarge) A bank reconciliation of cash per the accounting records to cash per the bank is critical. It will identify any amounts that were collected but not deposited (assuming the initial accounting record was properly prepared and recorded).

However, simply identifying the reconciling items is not sufficient; they must be researched and cleared. Following is an example of a simple bank reconciliation (click to enlarge image). See if you can find the five problems/errors. (Click "READ MORE" below to see the answers.) Deadly Sin #3 - Lack of Accountability for Cash Drawers.

If only one employee is responsible for a cash drawer, it is clear who is responsible for the cash. When two or more employees place cash into the same drawer, that commingling corrupts the internal controls. At most retail stores, when an employee ends his shift, he takes the drawer with him and the new employee brings her own drawer.

While working on an audit of a municipal golf course, the Finance Director asked me to perform a “secret shopper” test. I went to the pro shop and selected a sleeve of golf balls to purchase. I waited until the clerk was busy, slapped a $20 bill down on the counter, and yelled “keep the change” as I rushed out the door. A few days later, I reviewed the cash register tape and found the transaction had not been rung up and no overage was reported in the daily cash reconciliation. The Finance Director wanted to fire the responsible employee but since more than one employee was ringing cash into the same cash drawer, there was no way to prove who was responsible.

The next post, part 3 of this series, will cover the next two "deadly sins": Failure to Make Deposits Intact & Lack of Responsible Environment. Read how to avoid them.

For more detailed guidance on how to avoid any of these "deadly sins," please contact me directly: kharper@kevinharpercpa.com For continued tips on how to avoid common cash handling pitfalls and other tips, please subscribe to our newsletter here (we will never spam you – promise!)

Comments

|

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

Search Across Entire Site:

HELPFUL LINKS:

|

461 2nd Street, #302

San Francisco, CA 94107 (510) 593-5037 KHarper@kevinharpercpa.com |

RSS Feed

RSS Feed