|

An important task for any finance department is account reconciliation.

Items recorded as assets and liabilities at some point usually get paid, collected, depreciated or disposed; however, the related accounting entry to remove these items from the balance sheet does not always get made. For example, an operating department may dispose of a capital asset without notifying the finance department or a cash collection may have been recorded as a revenue instead of an offset to the receivable. Without regular account analyses, these types of errors can accumulate on the balance sheet causing both balance sheet accounts and revenues/expenses to be misstated by a significant amount. Here are the five most important steps to good account reconciliation procedure:

How to Create Account Analysis Assignments

When creating account analysis assignments, it is important that every balance sheet account will be assigned to a reconciler (see step 2 above) and reconciled regularly, including fund balance accounts.

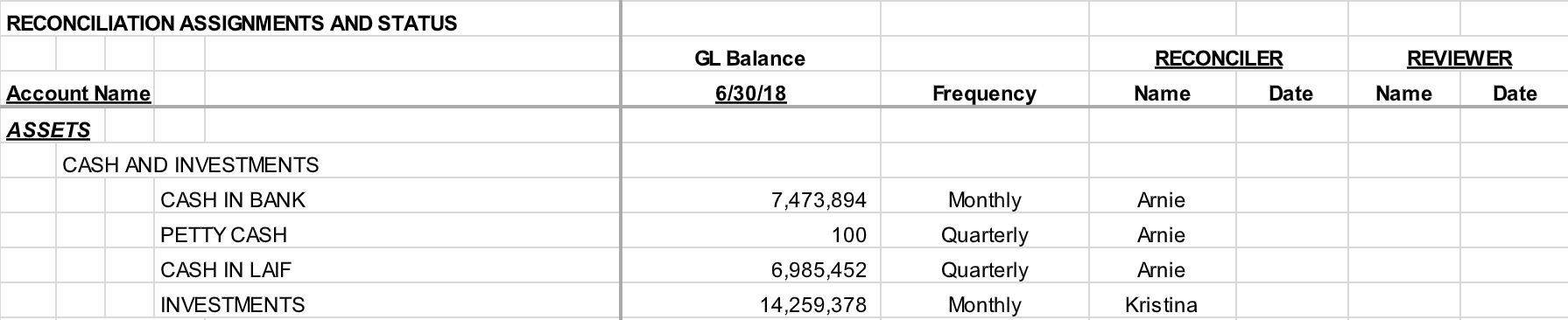

In this attached template to track reconciliation assignments and status, you can see that the balance sheet starts with a record of every balance sheet account (column F) and its related account balance (column G). The GL accounts are combined into categories as appropriate (e.g., all cash accounts are combined, all capital asset accounts are combined, all debt accounts are combined). Then you add following the columns that track who is assigned to reconcile the account (column I), date last reconciled (column J), and finally the date the reconciliation was reviewed (column K) and by whom (column L).

(Click the image above to download the account reconciliation assignment in Excel.)

If you follow these steps, you can keep your account reconciliation more accurate, more up to date, and more efficient for all departments involved.

If you’d like a more detailed walk-through, or have any questions in setting up or fixing your account reconciliation, please email or call Kevin directly for a free consultation:

Kevin Harper, CPA [email protected] (510) 593-503

Don't miss out on more tips for improved account reconciliation and other free tools — subscribe to our newsletter here (we hate spam just as much as you do, so we'll only send you useful information)!

Comments

|

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

RSS Feed

RSS Feed