|

As mentioned in our previous blog posts any local or state government that passes federal funds to a subrecipient who is a state, local government, Indian tribe, institution of higher education, or nonprofit organization, is required to monitor those subrecipients according to the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (the “Uniform Guidance”) published by the Office of Management and Budget. One of the tasks the pass-through entity is required to perform to monitor each subrecipient is to review their annual financial report and any programmatic reports that the pass-through entity requires the subrecipient to submit. In the post below, we discuss reviewing subrecipient financial and programmatic reports. Click here to jump directly to our review.

Relevant Provisions from Uniform Guidance:

Following is a description of the monitoring that a pass-through entity is required by the Uniform Guidance to perform for each subrecipient:

§200.331 Requirements for pass-through entities.

(d) Monitor the activities of the subrecipient as necessary to ensure that the subaward is used for authorized purposes, in compliance with Federal statutes, regulations, and the terms and conditions of the subaward; and that subaward performance goals are achieved. Pass-through entity monitoring of the subrecipient must include: (1) Reviewing financial and performance reports required by the pass-through entity. (2) Following-up and ensuring that the subrecipient takes timely and appropriate action on all deficiencies pertaining to the Federal award provided to the subrecipient from the pass-through entity detected through audits, on-site reviews, and other means. (3) Issuing a management decision for audit findings pertaining to the Federal award provided to the subrecipient from the pass-through entity as required by §200.521 Management decision. (e) Depending upon the pass-through entity's assessment of risk posed by the subrecipient (as described in paragraph (b) of this section), the following monitoring tools may be useful for the pass-through entity to ensure proper accountability and compliance with program requirements and achievement of performance goals: (1) Providing subrecipients with training and technical assistance on program-related matters; and (2) Performing on-site reviews of the subrecipient's program operations; (3) Arranging for agreed-upon-procedures engagements as described in §200.425 Audit services. (f) Verify that every subrecipient is audited as required by Subpart F—Audit Requirements of this part when it is expected that the subrecipient's Federal awards expended during the respective fiscal year equaled or exceeded the threshold set forth in §200.501 Audit requirements. (g) Consider whether the results of the subrecipient's audits, on-site reviews, or other monitoring indicate conditions that necessitate adjustments to the pass-through entity's own records. §200.511 Audit findings follow-up. (c) Corrective action plan. At the completion of the audit, the auditee must prepare, in a document separate from the auditor's findings described in §200.516 Audit findings, a corrective action plan to address each audit finding included in the current year auditor's reports. The corrective action plan must provide the name(s) of the contact person(s) responsible for corrective action, the corrective action planned, and the anticipated completion date. If the auditee does not agree with the audit findings or believes corrective action is not required, then the corrective action plan must include an explanation and specific reasons.

The subrecipient is required to file a single audit report if it spends more in its fiscal year, inclusive of the federal funds received from the pass-through entity, than the amount of federal expenditures (currently $750,000) that would require a single audit per the Uniform Guidance.

For subrecipients that do not spend the amount of federal funds that requires a single audit, the subaward agreement should require annual financial statements audited in accordance with generally accepted auditing standards. It should require all subrecipients to identify in notes to the financial statements or in a supplemental schedule the amount of funds received from the pass-through entity for each pass-through entity program. Without such a schedule, the pass-through entity will not know whether the amounts and programs, for which it is providing funding, are included in the subrecipient’s audited financial report. Reviewing the Subrecipient’s Annual Financial Report

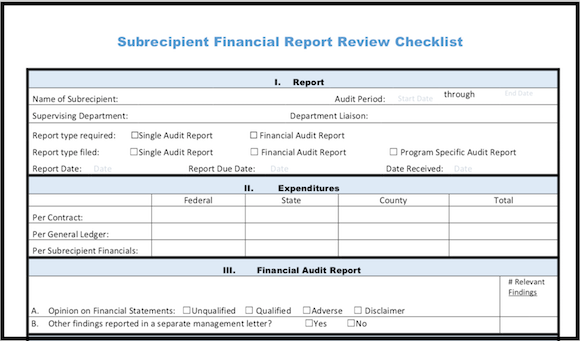

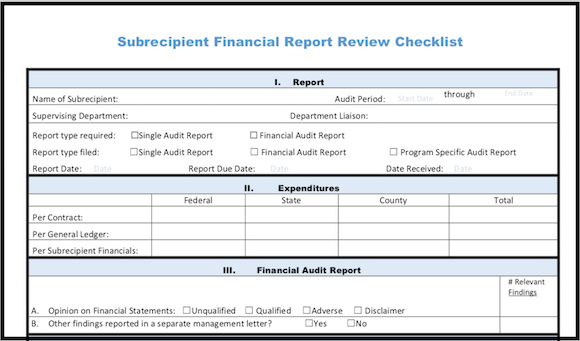

Following is an explanation of a Subrecipient Financial Report Review Checklist (click the link to view it in full screen or download it) that can be used to as a template to document the review of each subrecipient’s annual financial report. Below are the procedures that an experienced financial employee or consultant can use to complete the checklist:

Section I. Report - Complete this section for all reviews:

Section II. Expenditures - Complete this section for all reviews:

Section III. Financial Audit Report - Complete this section for all reviews:

Section IV. Single Audit Report - Complete this section only if a single audit report was filed by subrecipient:

Section V. Comments – Write comments about any unusual aspect of the review of financial report. For example:

These are items that the pass-through entity will continue to monitor during subsequent monitoring of the subrecipient.

Section VI. Conclusion – Conclude whether to accept or reject the financial report.

The report should be rejected if it is missing any required element; it should not be rejected due to having findings. Enter the name and date of the person performing the review of the financial report and the person reviewing the completed Subrecipient Financial Report Review Checklist. Certain portions of the Subrecipient Financial Report Review Checklist may not be able to be completed when a subrecipient financial report is rejected. When the subrecipient ultimately submits the required information, the Subrecipient Financial Report Review Checklist should be updated. After the Review: Management's DecisionAfter the review of the financial report is complete, prepare a management decision letter based on the results of the review. Use our Management Decision Template (click the link to view or download it in Word-format) to prepare the letter. A management decision letter should be sent to the subrecipient informing them of the results of the review. If the report is rejected, or there are relevant findings, provide the subrecipient with a specific list of items they must provide the pass-through entity and the due date for each. This management decision is required to be issued within six months after the pass-through entity’s receipt of the subrecipient financial report. For each finding, ask for a corrective action plan that includes the following: (a) List of tasks that will be done (“Planned Actions”), (b) who will perform each task (“Responsible Person”), and (c) by what date each task will be done (“Due Dates”). Although the auditee is required to include their response to each finding in the schedule of findings within a single audit report, such management’s response does not usually include all required elements of a corrective action plan. Reviewing Subrecipient Programmatic Reports

The Uniform Guidance requires pass-through entities to review all programmatic reports that they require subrecipients to submit. The purpose of the review of programmatic reports should be to determine whether there are any indications that the subrecipient is not complying with the provisions of the subaward agreement or the federal program. Any noncompliance matters and any indications of increased risk of noncompliance noted should be documented and followed up on during subsequent monitoring tasks. The pass-through entity should obtain a corrective action plan from the subrecipient for noncompliance noted, should review the plan to assure it is adequate and should monitor the plan is implemented adequately and timely. Reviews of programmatic reports should be documented similarly to that described above for annual financial reports.

For Quick Reference – Attachments/Files in this Blog Post:

Other Blog Posts Related to Subrecipient Monitoring:

We have previously provided guidance on subrecipient monitoring in these blog posts (this list will get more extensive as new posts are added on):

Watch for upcoming blog posts about the Uniform Guidance requirements: ● Determining Appropriate Level of Monitoring ● Data Collection

If you would like hands-on help on how to improve your subrecipient risk management, please contact Kevin directly for a free consultation:

Kevin Harper, CPA [email protected] (510) 593-503

If you'd like to get more free tips, as well as downloadable tools and templates for your agency, please join our mailing list here!

(We send 1-2 emails a month at a maximum, and only send useful information. You can unsubscribe at any time.) |

The Government Finance and Accounting BlogYour source for government finance insights, resources, and tools.

SEARCH BLOG:

Meet the AuthorKevin W. Harper is a certified public accountant in California. He has decades of audit and consulting experience, entirely in service to local governments. He is committed to helping government entities improve their internal operations and controls. List of free Tools & Resources

Click here to see our full list of resources (templates, checklists, Excel tools & more) – free for your agency to use. Blog Categories

All

Need a Consultation?Stay in Touch! |

RSS Feed

RSS Feed